“Undesirable” businesses

The ones payment processors don't want to do business with

@DirectorJoshua something has to be done. #chase has fucked with people before with other issues. Should not get away with shit like this.

If you want to accept digital payments today you need to partner with a payment processor like Stripe or PayPal. Usually, that’s not a problem, but what if they say no?

This is the reality for certain businesses with high charge back rate or that exists in a legal and moral gray area. If you view it from the payment processor’s point-of-view it might make sense—they’re just minimizing their risk. Though, that’s of little comfort to those being rejected.

Here are some examples of affected businesses:

- Adult entertainment (anything remotely related to porn)

- Auctions

- Cannabis

- Cryptocurrencies (how ironic)

- Gambling

For whatever reason, these businesses are deemed high risk and undesirable; despite them being legal, they might not be able to accept digital payments. This is something that cryptocurrencies solve.

Pot stores are cash-only

Pot stores in the United States are in a weird legal place. While they’re legal—to various degrees—in many states, they’re illegal under federal law. Kind of like Schrödinger’s cat: they’re legal yet simultaneously illegal.

Because banks in the US are regulated both on a state and federal level, banks don’t want anything to do with them. Payment processors take a similar stance, forcing the stores to be entirely cash-only.

We’re talking large amounts of money here, for example two businesses in Denver generated $250,000 to $350,000 in monthly sales—all in cash. This all needs to be counted, recounted, transported and stored. Large amounts of cash needs large amounts of secure storage, which means renting warehouses and hiring armored trucks and armored guards.

They are absolutely dependent on nearby ATMs, because the move towards cashless payments mean people don’t usually carry that much cash. In fact many stores have an ATM inside the store itself, to sort-of allow people to pay with credit cards.

Not having access to digital payments hurts, but there are workarounds. Cash does work in physical stores. There might also be (uncertain) ways to accept digital payments, a basic requirement for online stores.

Expensive and dubious workarounds

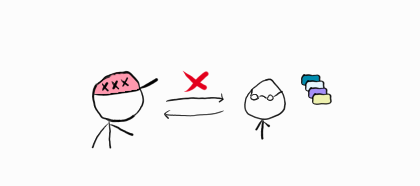

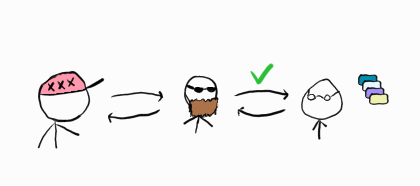

But some “undesirable” companies do accept credit cards. Does that mean the problem has been solved? Unfortunately, not really.

For example, porn is a business with very high rate of charge backs. Just think about it: what happens if your significant other would come across a charge to “XXX-Teens” or similar? Of course, you’d exclaim “my card must’ve been compromised!” and quickly call your bank to freeze your card and issue a charge back.

Therefore, most payment processors explicitly forbid porn sites, making it very difficult to accept credit cards directly.

Instead, they have a third-party request the payment on their behalf and do some shady stuff. They can for example claim the payment is for another type of business, which isn’t banned by the payment processor.

These things are in the gray area legal wise, so the companies that do this have high fees—VERY high fees. While regular payment processors may have ~3–4% fees, these intermediary fees can be as high as 30%. That’s ludicrously expensive for low margin businesses.

Why does it matter?

First they came for the socialists, and I did not speak out—

because I was not a socialist.Then they came for the trade unionists, and I did not speak out—

because I was not a trade unionist.Then they came for the Jews, and I did not speak out—

because I was not a Jew.Then they came for me—

and there was no one left to speak for me.

You might wonder what does it matter if these businesses disappear. Maybe you don’t gamble, don’t use cannabis and find porn deplorable—which is fine. But what about the thoughts of other people?

The cannabis business is experiencing explosive growth, hinting at how many people do care. Porn is another thing that is very popular—but very few would admit they watch it. I can see why some people object against them… but what’s the problem with auctions? (Other than being an easy target for charge back fraud.)

Why should people running and using legal businesses be punished for arbitrary reasons? A society that punishes people for doing something legal seems insane to me. (Yes, legality is different from morality, a topic we’ll revisit in the chapter about darknet markets.)

Are cryptocurrencies the solution?

Cryptocurrencies give you permissionless digital payments; they solve the problem of accepting payments very well. But they’re not a complete solution, at least today.

As we discussed in Are cryptocurrencies money?, they’re very volatile and not widely accepted. Businesses still need to convert cryptocurrencies to fiat to be able to pay their bills and salaries, and the workers in turn need to pay their bills. To sell them for fiat, you still need to go through exchanges who—you guessed it—can refuse to do business with you.

While cryptocurrencies improves the situation today, we would really need to bypass all third-parties for a great solution. This means you should be able to pay all expenses with cryptocurrencies so you can’t get blocked by a third-party anywhere on the line.

But there are related problems cryptocurrencies can’t solve. Banks serve a very important function: they lend businesses money, and there’s no good solution if they say no. It can also be more secure to let banks store large sums of money than keeping it yourself.